Agricultural Fertilizer Market

The global agricultural fertilizer market is experiencing a real crisis due to the effects of the Russian-Ukrainian War and China’s curtailment of its exports of raw materials for fertilizer.

In this article we will try to explore the size of this industry and the market in Saudi Arabia, follow us.

To request feasibility studies services:

https://www.strategymission.org/en/request-services/

In 2022, 5.3 million tons of fertilizer was consumed in Saudi Arabia; This represents a decrease of -10.9% compared to 2021 figures. Total consumption volume increased by an average annual rate + 1.3% from 2013 to 2022.

The market is expected to continue the upward trend over the next eight years. It expands at a projected CAGR + 1.1% from 2022 to 2030, which is expected to reach a market size of 5.8 million tons by the end of 2030.

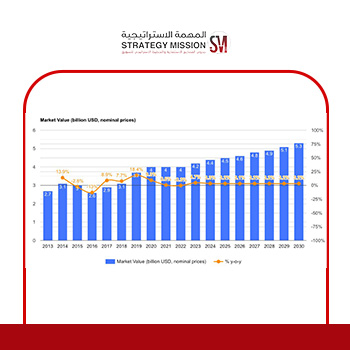

In value terms, the market is projected to increase at a projected CAGR + 3.4% for the period from 2022 to 2030, which is expected to reach a market value of $5.3 billion in 2030.

Ammonium nitrate (1.3 million tons), ammonium diphosphate (1 million tons) and calcium ammonium nitrate (CAN) (884 thousand tons) were the main products for fertilizer consumption in Saudi Arabia, with a combined share of 59% of the total volume.

In 2022, domestic fertilizer production in Saudi Arabia fell slightly to 13 million tons, remaining relatively unchanged compared to 2021 figures. Total production volume increased by an average annual rate + 2.9% from 2013 to 2022; The trend pattern remained relatively stable, with fairly noticeable fluctuations recorded.

Urea (4.5 million tons), ammonium diphosphate (3.3 million tons) and ammonium nitrate (1.4 million tons) were the main products for domestic fertilizer production in Saudi Arabia, with a combined share of 73% of total production.

In 2021, Jordan (132 thousand tons) accounted for Saudi Arabia’s largest fertilizer supplier, accounting for 55% of total imports. Moreover, fertilizer imports from Jordan exceeded three times the figures of Egypt’s second largest supplier (52 thousand tons). China was third in this ranking (13 thousand tons) with a share of 5 .4%.

No comment